BP has agreed to sell its interests in the Andrew area and the Shearwater field, both located in the central UK North Sea, to Premier Oil for £474 million.

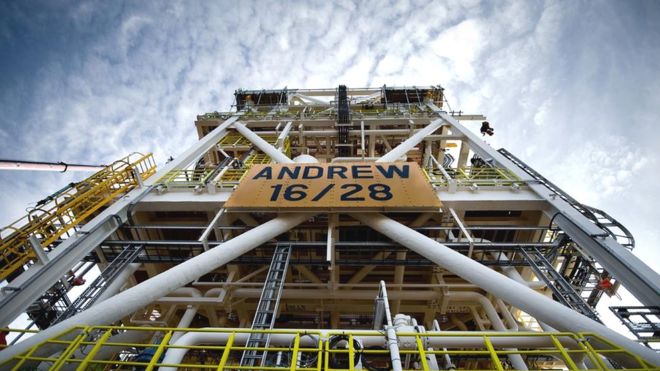

BP own and operate several assets in the Andrew area including the Andrew platform, the Andrew field (62.75%), Arundal field (100%), Cyrus field (100%), Farragon field (67%) and Kinnoull field (77.06) plus associated subsea infrastructure in each.

The five fields all produce through the Andrew platform, located 140 miles north-east of Aberdeen, with an average of 25,000 to 30,000 barrels of oil equivalent per day.

Also part of the deal is BP’s 27.5% stake in the Shearwater field, operated by Shell. This is a high pressure, high temperature reservoir located 140 miles east of Aberdeen that produces around 14,000 barrels of oil equivalent per day.

Explaining the sale, BP’s North Sea regional president Ariel Flores said “BP has been reshaping its portfolio in the North Sea to focus on core growth areas, including the Clair, Quad 204 and ETAP hubs. We’re adding advantaged production to our hubs through the Alligin, Vorlich and Seagull tieback projects.

“As a result of this focus, we have also now decided to divest our Andrew and Shearwater interests, believing them to be a better strategic fit for another owner. We are confident that Premier Oil, already a significant operator in the North Sea, is the right owner of these assets as they seek to maximise their value and extend their life.”

BP North Sea regional president Ariel Flores said: “BP has been reshaping its portfolio in the North Sea to focus on core growth areas.

“As a result of this focus, we have also now decided to divest our Andrew and Shearwater interests, believing them to be a better strategic fit for another owner.

“We are confident that Premier Oil, already a significant operator in the North Sea, is the right owner of these assets as they seek to maximise their value and extend their life.”

Premier chief executive Tony Durrant said: “These acquisitions are in line with our stated strategy of acquiring cash generative assets in the UK North Sea.

“We look forward to realising the significant long-term potential of the Andrew and Shearwater assets through production optimisation, incremental developments and field life extension projects.”

Mike Tholen, upstream policy director for industry body Oil and Gas UK, said: “These major transactions demonstrate the continuing confidence in the industry, highlighting that improving competitiveness in the UK North Sea is attracting commercial interest from a diversity of operators.”

The deal is expected to be completed at the end of the third quarter of the year.